How much do elections impact the stock market and portfolio returns? Should they even matter to long-term investors? With November 5 approaching, these are key questions for investors.

We analyzed over 90 years of data and found five ways elections influence the market:

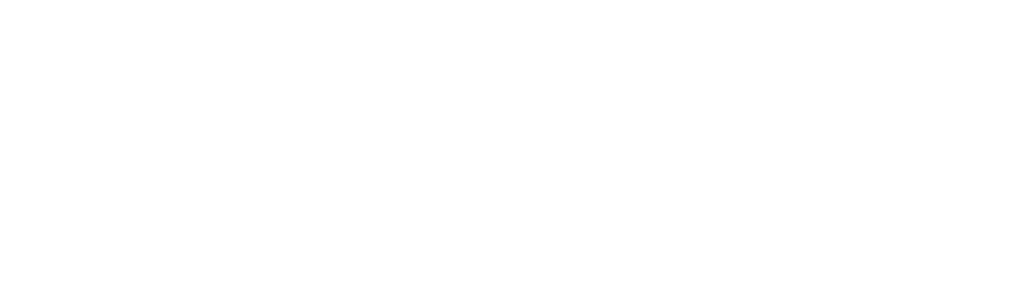

1. Markets Trend Higher Regardless of Who Wins:

Historically, which party is in power hasn’t significantly affected long-term stock market returns. Since 1933, under both Democratic and Republican presidents, the market has generally trended upwards.

2. Gridlock or Sweep? Stocks Have Risen Either Way:

Equities have performed well regardless of whether one party controls the White House and Congress. Since 1933, stocks averaged strong returns in both scenarios.

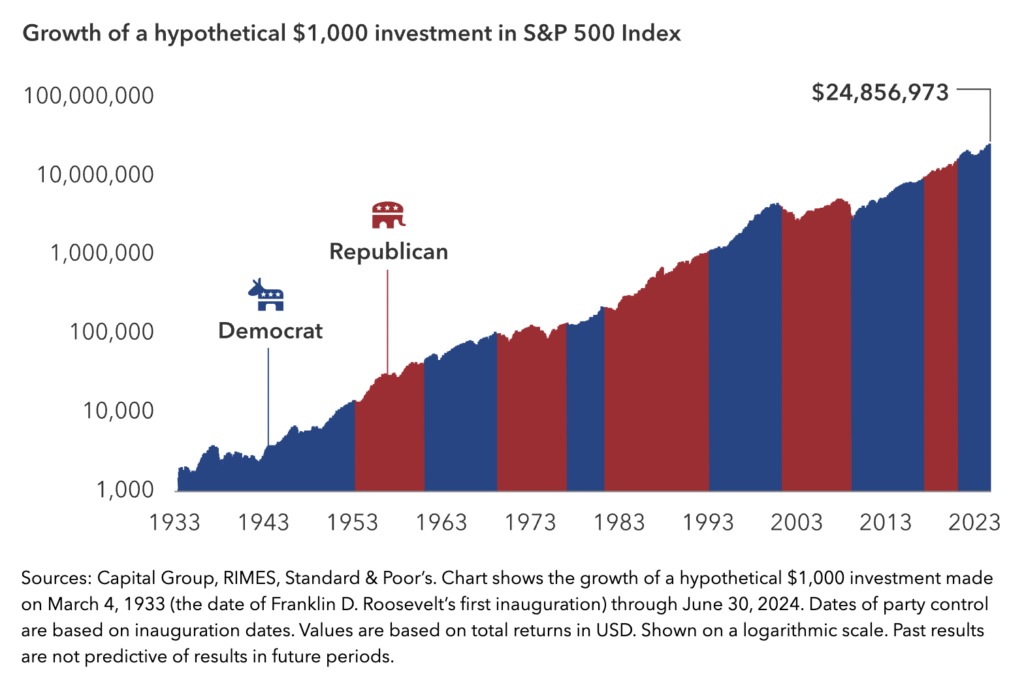

3. Markets Tend to Predict Election Results:

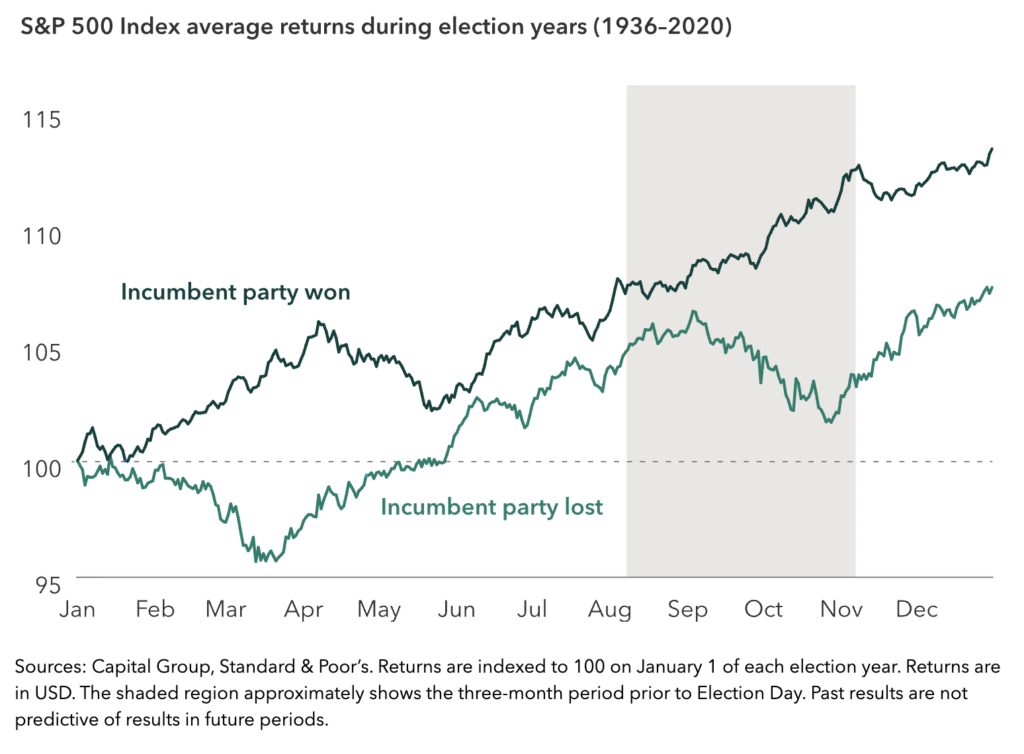

4. Investors Become More Conservative in Election Years:

During election years, investors tend to pour assets into safer investments, like money market funds. However, waiting for post-election clarity can lead to missed opportunities.

5. Moving to Cash Hurts Long-Term Returns:

Investors who move to cash during election years tend to have worse outcomes compared to those who stay invested or contribute regularly. Long-term strategies generally outperform attempts at market timing.

The key takeaway? Focus on your long-term goals and avoid letting political uncertainty influence your investment decisions.